Unlocking the Power of Card Readers: Your Guide to Choosing the Right Device for Every Need

In today's fast-paced digital landscape, the importance of efficient payment processing cannot be overstated. According to a report by Statista, the global mobile payment market is projected to reach $12.06 trillion by 2028, highlighting the growing reliance on card readers for transactions. As businesses and consumers increasingly shift towards cashless options, selecting the right card reader becomes essential for optimizing payment processes, enhancing customer experiences, and ensuring security.

With various types and functionalities available, understanding the distinct advantages of each card reader type is critical for fulfilling specific needs, whether that be for retail environments, e-commerce platforms, or on-the-go transactions. This guide aims to demystify the selection process, empowering users to make informed decisions when it comes to integrating card readers into their operations.

Understanding Different Types of Card Readers Available in the Market

When it comes to selecting the right card reader for your needs, understanding the different types available in the market is crucial. Card readers can generally be categorized into three main types:

magnetic stripe readers,

chip card readers, and

contactless readers.

According to a report by MarketsandMarkets, the global card reader market is expected to reach $3.45 billion by 2025, driven by the increasing adoption of cashless payment systems.

Magnetic stripe readers remain popular for their simplicity and affordability; however, they are gradually being phased out in favor of more secure options.

Magnetic stripe readers remain popular for their simplicity and affordability; however, they are gradually being phased out in favor of more secure options.

Chip card readers, also known as EMV readers, provide enhanced security by requiring a chip card to be inserted for transactions. These devices have gained traction in recent years due to heightened awareness around payment security and are projected to account for over 60% of the total card reader market share by 2025 (Source: Technavio).

Furthermore, contactless readers, which use NFC (Near Field Communication) technology, are becoming increasingly prevalent, especially in mobile payments. A study by Allied Market Research indicates that the contactless payment segment is expected to grow at a CAGR of 13.4% from 2020 to 2027, highlighting the shift towards convenience and speed in transactions. Keeping these options in mind will help you choose the right card reader tailored to your unique requirements.

Evaluating Key Features for Your Card Reader Needs

When it comes to choosing the right card reader, evaluating key features is essential to meet your specific needs. Consider the types of cards you'll be reading—whether it's credit cards, debit cards, or loyalty cards—as different devices offer varied compatibility. Additionally, assess the connectivity options available, such as USB, Bluetooth, or NFC, to ensure seamless integration with your existing systems.

Tip: Always look for a card reader with robust security features, including encryption and compliance with PCI standards. This will protect sensitive transaction data and build trust with your customers.

Another important feature to consider is transaction speed. A quicker processing time can enhance customer satisfaction and improve the overall efficiency of your operations. Battery life is also crucial for those on the go; a portable card reader with excellent battery capacity will serve you well in busy environments.

Tip: Check for user-friendly interfaces and support for mobile payment apps if you often find yourself in dynamic selling environments, as this can significantly simplify the transaction process.

Comparing Card Reader Compatibility with Various Devices

When selecting a card reader, compatibility is a crucial factor to consider, as it determines how well the device can integrate with your existing systems. Different types of card readers are designed to work with various types of cards and devices, ranging from credit and debit cards to specialized storage media like CFexpress cards. Understanding the specific needs of your equipment, whether it be for personal finance management or professional media production, is essential in making the right choice.

Additionally, the security features of card readers are becoming increasingly important in today's digital landscape. As incidents of credit card skimming and data breaches rise, it is vital to choose devices that offer robust security protocols. For instance, some advanced card readers are equipped with technology that blocks RFID signals, providing an extra layer of protection against unauthorized access. By comparing card reader options and their compatibility with your devices while prioritizing security features, you can ensure a reliable and secure experience for all your card transactions.

Assessing Security Features in Card Readers for Safe Transactions

When selecting a card reader, security features should be your top priority. Card readers can vary significantly in their ability to protect sensitive financial information. Look for devices that offer encryption during data transmission as well as secure storage options for card information. Strong encryption protocols, such as AES or TLS, ensure that even if data is intercepted, it remains unreadable to unauthorized users. Additionally, choose card readers that are EMV compliant, which adds an extra layer of security by requiring chip cards to authenticate transactions, helping to prevent fraud.

Another crucial aspect to consider is the card reader's ability to support contactless payment methods, which often come with built-in security features like tokenization. This technology replaces sensitive card details with a unique token during the transaction, safeguarding personal information from potential breaches. Moreover, look for card readers that offer multi-factor authentication options, such as requiring a PIN or biometric verification alongside card swiping. By prioritizing these essential security features, you can ensure safe transactions whether you are making purchases in-store or online.

Tips for Properly Maintaining and Caring for Your Card Reader

Proper maintenance of your card reader is essential for ensuring optimal performance and longevity. To start, always keep your device clean. Use a soft, dry cloth to gently wipe the surface, and avoid using harsh cleaners, which can damage the device. If the card slot becomes dirty, use a can of compressed air to remove debris. Regularly inspecting the device for signs of wear or damage can also help prevent malfunctions down the road.

Another critical aspect of caring for your card reader is ensuring that it is properly stored when not in use. Keeping it in a protective case can shield it from dust, moisture, and physical impacts. Additionally, be mindful of the environment in which you use your card reader; extreme temperatures and humidity can negatively affect its functionality. By following these simple yet effective maintenance tips, you can extend the life of your card reader and ensure it continues to meet your needs efficiently.

Related Posts

-

Mastering Your Card Reader Step by Step Guide for Beginners

-

How to Choose the Right Soda Machines for Your Business Needs

-

7 Tips to Optimize Your Card Reader for Vending Machine Success

-

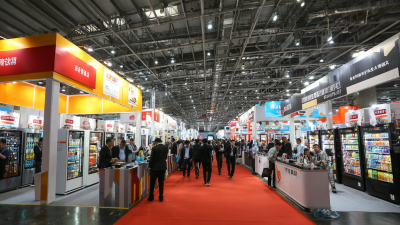

Snack Vending Growth Projections and Industry Insights at 2025 China Import and Export Fair

-

7 Best Refrigerated Vending Machines for 2023: Boost Sales with Smart Technology!

-

Exploring Vending Machine Financing Opportunities at China’s 138th Import and Export Fair 2025